Have you ever wondered how websites can instantly tell if a credit card number is valid—without even contacting the bank? While it might seem like magic, the truth is surprisingly straightforward. In this post, we’ll break down how credit card validation works, show you an example, and introduce you to a free tool where you can test it yourself.

🔍 The Secret Behind Credit Card Validation

When you type in your card details on a website, most systems use the Luhn algorithm (also called the “modulus 10” or “mod 10” algorithm). This clever math trick lets computers quickly check whether a card number could be real, based on its structure and a check digit, without talking to any servers or banks.

This is perfect for catching typos and invalid entries—saving time for both users and developers.

💳 Test and Learn: Try Credit Card Validation Yourself

The folks at this validation tool provide a step-by-step explanation using real examples. You can even type in your own test numbers to see how the system responds.

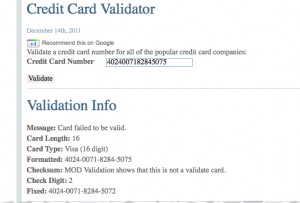

Here’s an example I tried:

Test Number: 4024-0071-8284-5075

Result: Card failed to be valid.

Card Type: Visa (16-digit)

Checksum: MOD validation failed.

The tool even suggested a “fixed” number for testing:

Fixed Number: 4024-0071-8284-5072

Result: Validated successfully!

🔗 Why This Matters for Developers and Testers

As a developer, testing your payment system with multiple card types is crucial. This tool helps you:

- ✅ Validate user input before sending it to a payment processor.

- ✅ Generate test card numbers for Visa, MasterCard, and AMEX.

- ✅ Avoid accidental fraud or using live data during testing.

Remember, these generated numbers are only for testing. They won’t process actual payments but are perfect for building robust systems.

🤔 Did You Know? Fun Credit Card Facts

- 💡 The first digit of a credit card identifies the industry. (4 = Visa, 5 = MasterCard, 3 = AMEX)

- 💡 The last digit is a check digit calculated from all previous digits using the Luhn algorithm.

- 💡 Card length and patterns vary by provider and region.

📌 Final Thoughts

Understanding credit card validation helps users avoid frustration and developers build smarter apps. Next time you see a quick “invalid card” error, you’ll know exactly what’s happening behind the scenes.

Depending on how long ago you canceled your cards, and the snidtang on the cards when you canceled, you might try to see if they will rehab one of the cards.You might go to the Bank of America website. They have a card selector that you can do that will not pull a hard inquiry for a recommendation. If you apply for a recommended card, then they will pull a hard. Orchard Bank and HSBC also have the card selectors but they are not as prime as BoA.Stay away from Cap One. They do not report your credit limit, only the amount that you charge. That will definately hurt your utilization and lower your scores.